Flat rate depreciation calculator

Depreciation Rate Calculator Cheap Sale 60 Off Www Ingeniovirtual Com Depreciation Methods Principlesofaccounting Com. 2020 Mercedes-Benz GLB launched in Malaysia.

We Do Not Recommend Any You Ll Be The Judge Read The Full Article Here Https Www Junespringmultimedia Com Blog Be Klasposters Tafeldiploma Thuisonderwijs

How Depreciation Is Calculated.

. Flat rate depreciation calculator. The depreciation rate for a building is less as compared to other assets that depreciate. The calculator should be used as a general guide only.

Depreciation Of Assets 1 Of 3 Flat Rate. Assets determines the depreciation rate using fixed rates including the basic rate adjusting rate and bonus rate. Annual Depreciation rate Cost of Asset Net Scrap Value Useful Life There are various methods to calculate depreciation one of the most commonly used methods is the.

Assets depreciating under flat-rate methods with a. Oracle Assets uses a flat-rate and either the recoverable cost or. Depreciation asset cost salvage value useful life of asset.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. The four most widely used depreciation formulaes are as listed below. Percentage Declining Balance Depreciation Calculator.

Depreciation rate varies across assets and is determined based on the nature and use of the asset. Flat rate depreciation calculator Related Articles. From RM 269k 52 seating.

USB ports to keep. Loan Amount Loan Term years. This depreciation calculator will determine the actual cash value of your Flat Built-Up using a replacement value and a 12-year lifespan which equates to 012 annual depreciation.

Flat-rate methods use a calculation basis of either the recoverable cost or recoverable net book value to calculate annual depreciation. Flat Rate EMI Calculator. Use a flat-rate method to depreciate the asset over time using a fixed rate.

Straight Line Depreciation Method. This depreciation calculator will determine the actual cash value of your Trailers using a replacement value and a 15-year lifespan which equates to 015 annual depreciation. How Depreciation Is Calculated.

There are many variables which can affect an items life expectancy that should be taken into consideration. Depreciation Calculation for Flat-Rate Methods. For a loan tenure of 3 years with flat interest rate of 1200 the total interest amount is 36000.

For example if you have an asset. This depreciation calculator will determine the actual cash value of your Suitcases using a replacement value and a 20-year lifespan which equates to 02 annual depreciation. Assets determines the depreciation rate using fixed rates including the basic rate adjusting rate and bonus rate.

:max_bytes(150000):strip_icc()/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

Annuity Due Definition

Car Depreciation Chart How Much Have You Lost Infographic New Cars Financial Tips Two Year Olds

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Lesson 8 8 Appreciation And Depreciation Youtube

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

How To Use The Excel Db Function Exceljet

Depreciation Calculation

Download Apartment Maintenance Accounts Excel Template Exceldatapro Excel Templates Excel Accounting

Depreciation Calculation For Flat Rate Methods Oracle Assets Help

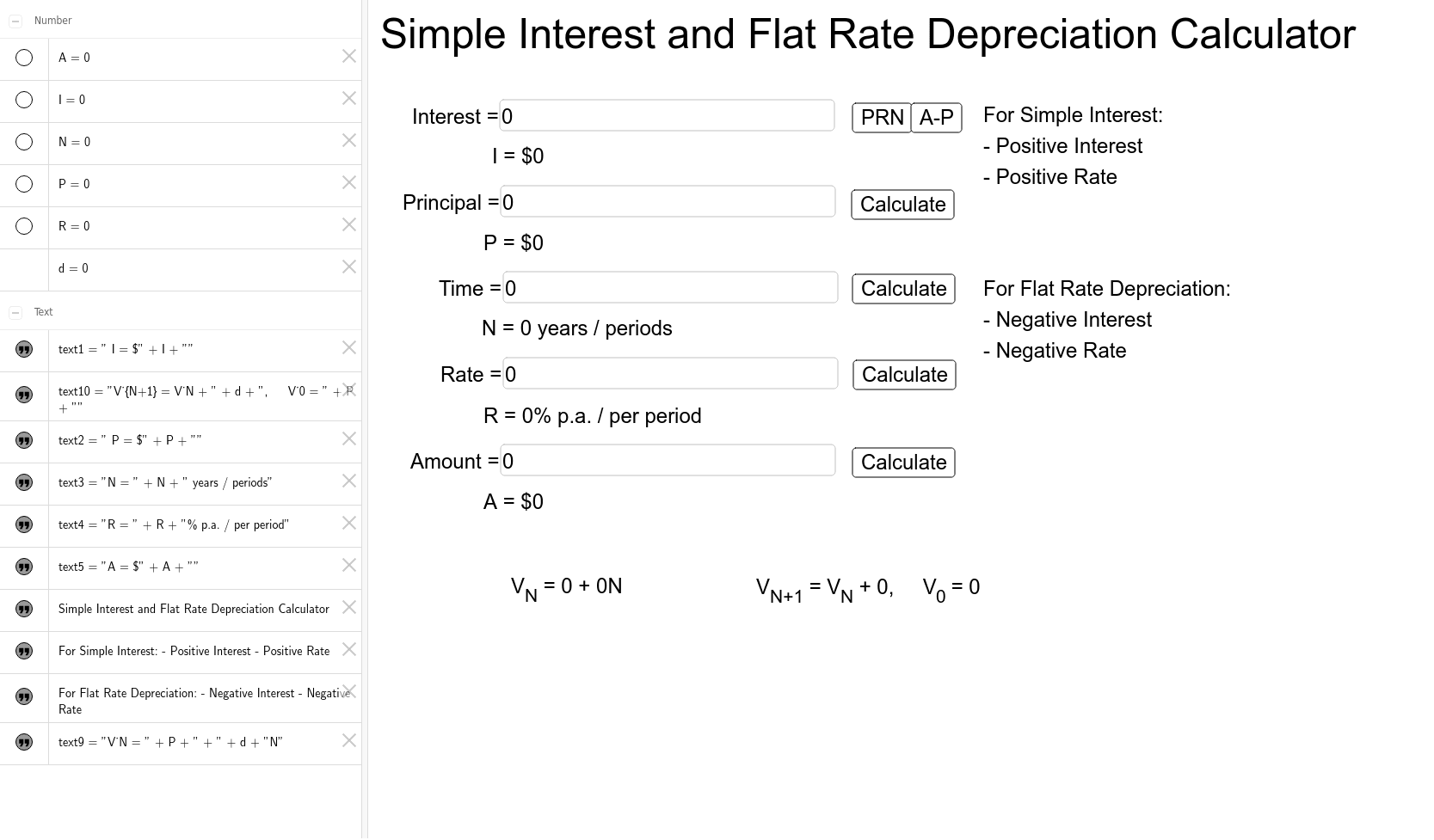

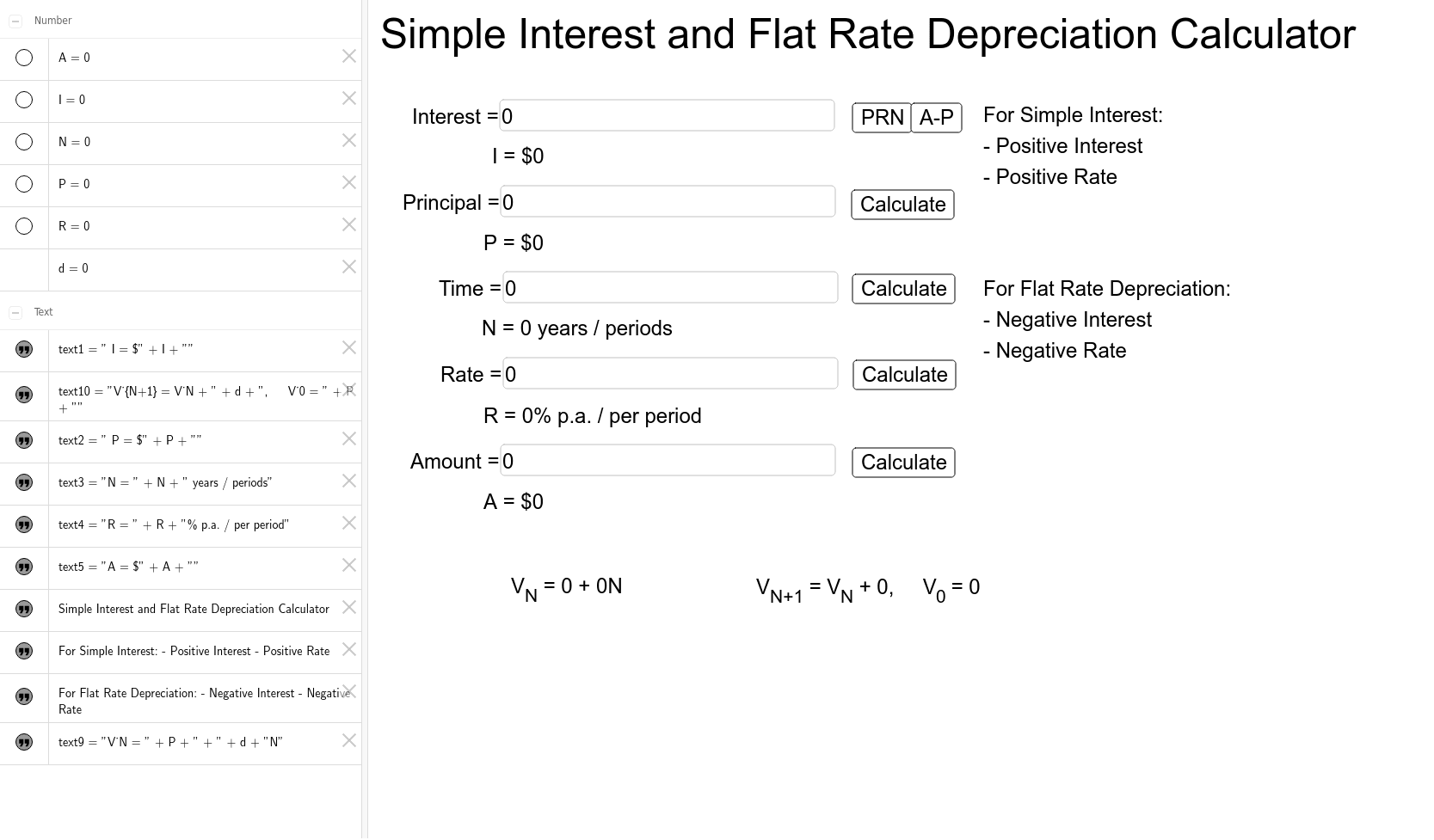

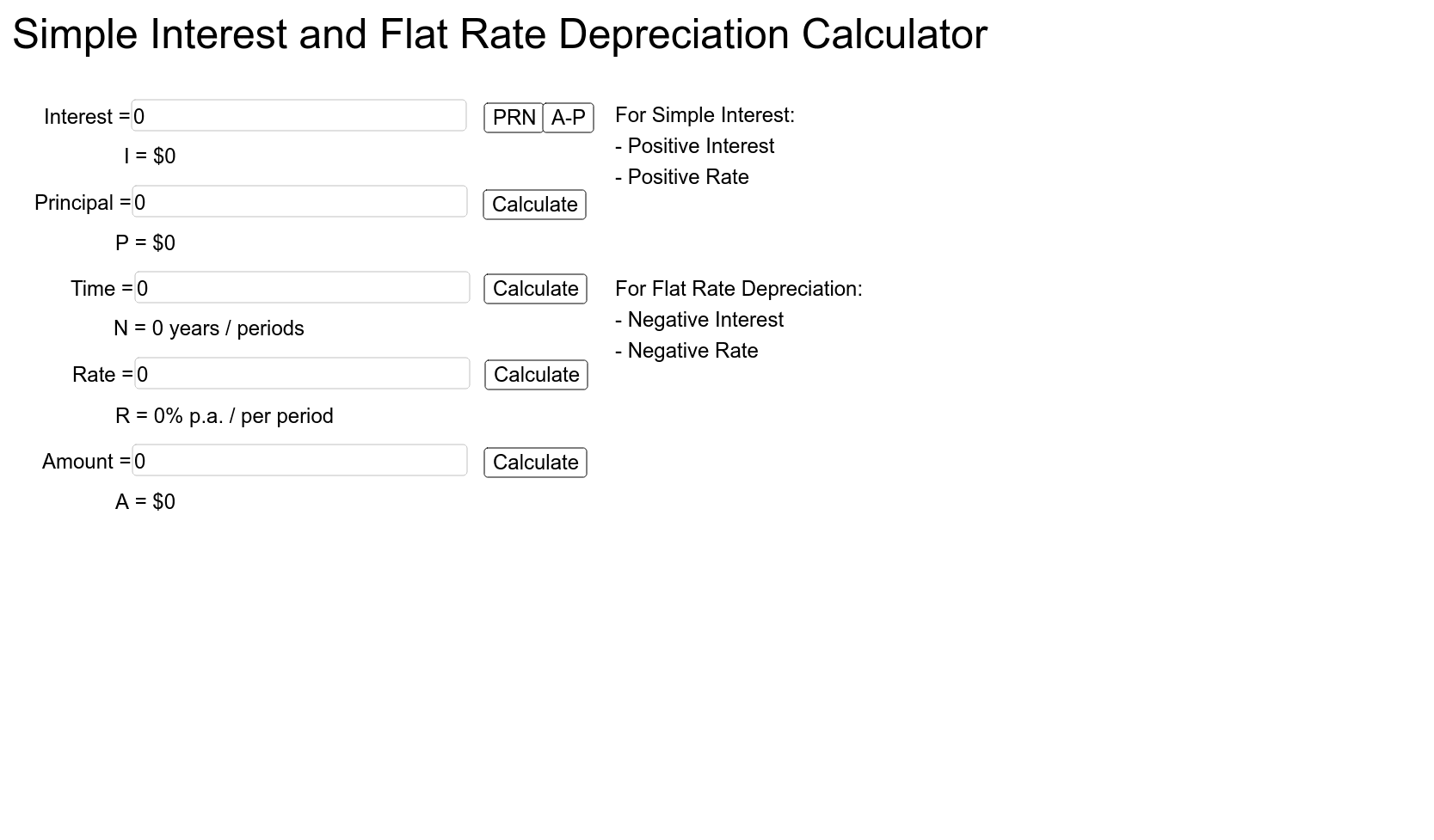

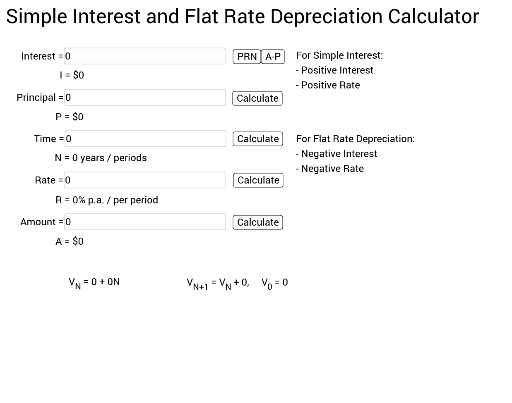

Simple Interest And Flat Rate Depreciation Calculator Vce Geogebra

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Annual Depreciation Of A New Car Find The Future Value Youtube

How To Use The Excel Db Function Exceljet

Depreciation Formula Calculate Depreciation Expense

Simple Interest And Flat Rate Depreciation Calculator Vce Geogebra

Depreciation Formula Calculate Depreciation Expense